Thermal conductive powders currently used to fill composite thermally conductive materials can be divided into multiple categories. According to the chemical composition of the material, it can be divided into three categories: metal, carbon powder and inorganic non-metallic powder. Oxide metal powder has good advantages in the field of preparing high thermal conductivity composite materials due to its good thermal conductivity and insulation properties.

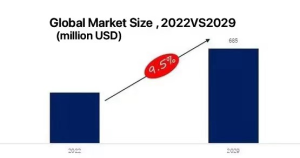

The global spherical alumina filler market size will be approximately US$398 million in 2023 and is expected to reach US$68.5 billion in 2029, with a CAGR of 9.5% in the next few years.

Spherical alumina filler, the overall global market size is expected to reach US$690 million in 2029

(The data in the figure above are taken from the latest report of QYResearch “Global Spherical Alumina Filler Market Research Report 2023-2029”)

Main drivers:

- National policy support: Policy support is the core driving force for industry development.

- As the functions of electronic products such as 5G communication equipment and high-end smartphones become increasingly complex and miniaturized, thermal interface materials solve the heat dissipation problem of core components of electronic products, thus driving the demand for spherical alumina. Thermal interface materials continue growing, with increasing requirements for conductive fillers, media purity, and radioactivity.

- new energy vehicles are showing a strong trend of replacing traditional energy vehicles, and market sales are gradually expanding. Power batteries are the core of new energy vehicles. Adhesives used in power batteries can effectively improve their performance and play a key role in achieving stability, efficiency, and safety. The demand for spherical alumina for new energy vehicle power battery adhesives will grow rapidly.

Main obstacles:

- The technical barriers to spherical alumina are relatively high. The biggest technical difficulty lies in the research and development of the spheroidization process and production equipment. There are currently no standard devices on the market. If new companies want to build new production capacity and produce spherical alumina with excellent quality and stability, they need to overcome relevant technical bottlenecks.

- Intensified competition in the industry: The rapid development of the new energy vehicle market in recent years has attracted a large amount of capital into the new energy industry, ultimately leading to an increase in the number of thermal ball companies in the aluminum industry. Traditional powder production companies are also diversifying and gradually increasing or expanding their spherical alumina production capacity. Enterprises such as Denhua and Anhui Yishitong have many new production capacity projects, rapid growth in production capacity, increased product supply, and intensified product price competition.

Industry development opportunities:

Industry development opportunities are mainly reflected in three aspects:

- Policy support

- Breakthroughs in higher thermal conductivity and high filling technology

- The promotion of downstream demand

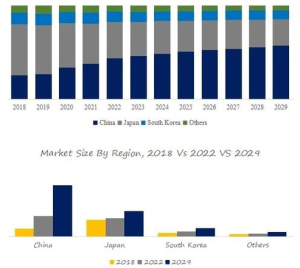

Global core manufacturers are mainly located in Japan, South Korea and China. In terms of output value, Japan and China account for more than 80% of the market share.

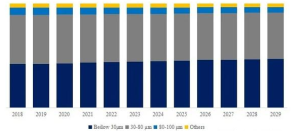

Spherical alumina filler. Global market size, segmented by product type, 30-80um dominates

(The data in the figure above are taken from the latest report of QYResearch “Global Spherical Alumina Filler Market Research Report 2023-2029”)

In terms of product types, 30-80μm is currently the most important segmented product, accounting for approximately 46% of the market share.

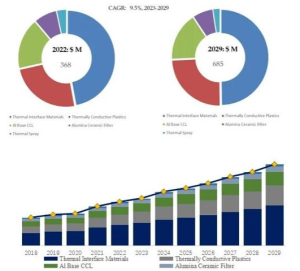

The global market size of spherical alumina fillers is broken down by application details. Application1 is the largest downstream market, accounting for xx percentage.

(The data in the figure above are taken from the latest report of QYResearch “Global Spherical Alumina Filler Market Research Report 2023-2029”)

In terms of product type, thermal interface materials TIM is currently the main source of demand, accounting for approximately 49%. When used as thermal interface materials, spherical aluminum fillers can be used in thermal pads, thermal grease, thermal potting glue, thermal gel, etc.

The end applications currently driving demand for spherical alumina are mainly photovoltaic cells, new energy vehicle power batteries, 5G communications/high-end electronic products, chip packaging, etc. Many companies in the industry have used spherical alumina for chip packaging. At the same time, the future development trend of spherical alumina is mainly high purity and low radioactivity.

Global Spherical Alumina Filler Size. Share of major production regions (by output value)

(The data in the figure above are taken from the latest report of QYResearch “Global Spherical Alumina Filler Market Research Report 2023-2029”)

Regarding output value, Japan is the main producer from 2018 to 2021, with an average share of 50%. After 2021, with the expansion of production lines of companies such as China Baitu High-tech and Lianrui New Materials, they will gradually occupy the market share of Japan and South Korea. By 2023, China’s output value share will exceed 45%. In the next few years, China will occupy the main market share.

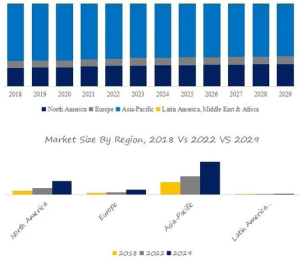

Global major market size of spherical alumina filler:

(The data in the figure above are taken from the latest report of QYResearch “Global Spherical Alumina Filler Market Research Report 2023-2029”)

Supplier

TRUNNANO is a supplier of spherical aluminum oxide (Al2O3) powder with over 12 years experience in nano-building energy conservation and nanotechnology development. It accepts payment via Credit Card, T/T, West Union and Paypal. Trunnano will ship the goods to customers overseas through FedEx, DHL, by air, or by sea. If you are looking for high quality spherical aluminum oxide (Al2O3) powder, please feel free to contact us and send an inquiry.